Market Review 7th April 2025

Simplify the craziness

DAILY REVIEW

N

4 min read

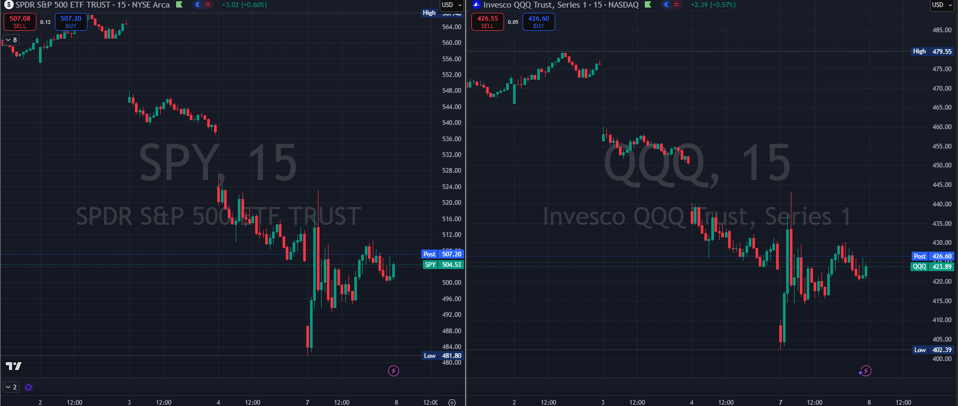

Monday, April 7, 2025, brought another bout of market turbulence as equity indexes closed mostly in the red. The catalyst? A sweeping new 10% U.S. import tariff policy announced last week, which excluded only Canada and Mexico (conditionally), is sending ripples across global financial markets.

📉 Major Index Performance

S&P 500: Down sharply, now 18% off its mid-February all-time high

Dow Jones: Closed in the red as trade-sensitive stocks took a hit

Nasdaq: Edged higher, thanks to strength in tech stocks

VIX (Volatility Index): Spiked as investor anxiety grew

Markets initially rebounded on rumors of a 90-day tariff delay but reversed course as those claims were debunked, ending the day in a risk-off tone.

🌐 Global Impact: Asian Markets Hit Hard

Asian equities bore the brunt of global concerns:

Nikkei (Japan): Fell ~8%

Hang Seng (Hong Kong): Tumbled over 13%

The ripple effects of the tariff announcement are already visible as global investors pull risk exposure from the table.

💬 Trump’s Tariff Threats Escalate

President Trump doubled down on protectionism, warning that additional 50% tariffs could be imposed on China if retaliatory duties are not rolled back. His Sunday and Monday statements underscored a hardline stance:

"We’re not going to have deficits with your country. To me, a deficit is a loss." — President Trump

🧾 Policy Breakdown:

April 2: Blanket 10% tariff on all imports (excluding Canada & Mexico under USMCA)

April 5: Policy enforcement begins

April 9: Additional higher tariffs on large deficit nations take effect

China's retaliation: 34% tariff on U.S. goods beginning April 10

EU Response: Preparing countermeasures, covering 70% of exports to the U.S.

Canada: Imposed tariffs on U.S. auto imports

💼 Economic Fallout & Investor Response

🔍 Corporate Impact:

Tariffs threaten higher input costs, compressing profit margins

Multinational firms are at risk from disrupted supply chains

Companies may pass costs onto consumers, potentially reducing consumer spending

🏠 Household Impact:

Increased prices reduce real incomes

Inflation-adjusted household budgets may get tighter

Inflation readings are expected to rise in the coming months

📊 Market Volatility: A Historical Perspective

While current volatility is unsettling, it isn't unprecedented. Historical data from the S&P 500 post-20% drops offers perspective:

TimeframeAvg. Return Post 20% Drop1-month+4.1%6-month+0.7%12-month+10.5%

“Volatility is uncomfortable, but normal,” analysts reiterate. Past data shows strong rebounds post-drawdowns.

📈 Bonds & Treasuries Reverse Losses

Amid equity weakness, bond yields initially fell but reversed course by end of trading:

10-Year U.S. Treasury: Rose to 4.2%

10-Year GoC Yield: Climbed to 3.04%

These moves suggest investor concerns about long-term inflation and growth impacts due to tariffs.

🇨🇦 Canada’s Economic Outlook

Despite volatility, Canada’s fundamentals remain strong:

Q4 2024 GDP growth: +2.6%

Export resilience expected due to U.S. exclusions under USMCA

Canadian investment-grade bonds: Positive YTD, offering some portfolio cushioning

U.S. Economic Position: From Strength to Uncertainty?

🌱 Strengths Heading into 2025:

Above-trend GDP over past 2 years

Healthy household balance sheets

March Non-Farm Payrolls: +228,000 jobs (vs. 130,000 expected)

⚠️ Risks Ahead:

Escalating trade tensions could reverse recent strength

Recession risks are rising but not guaranteed

Policymakers must tread carefully to avoid market overreaction

🛡️ Diversification: The Investor’s Best Friend

As traditional markets enter a correction, well-diversified portfolios are outperforming:

U.S. bonds: Providing safe haven

International equities: Outperforming U.S. counterparts

Canadian markets: Showing resilience

“Diversification remains the key to long-term investing success,” say strategists.

🔄 Rotation in Leadership: Sector Winners & Losers

📉 Sectors Under Pressure:

Industrials: Hit by trade fears

Materials & Autos: Highly tariff-sensitive

Retail: Bracing for input cost increases

📈 Relative Strength in:

Technology (Nasdaq): Benefited from rotation and innovation strength

Healthcare: Considered defensive in volatile times

Utilities & Staples: Benefiting from flight-to-safety positioning

💡 Strategic Takeaways for Investors

Avoid panic-selling: Emotional decisions often result in long-term underperformance.

Stick to your financial plan: Adjust only if goals or timelines have changed.

Rebalance portfolios: Maintain diversification across asset classes and geographies.

Stay informed, not reactive: Monitor developments without making knee-jerk changes.

🔮 What to Watch This Week

📅 April 9:

Tariff hike goes into effect

Markets watching for clarity or easing in tone from policymakers

🗓️ April 10:

China's 34% retaliatory tariffs begin

Additional macro data releases may impact Fed’s outlook

📉 Big Movers: Companies Affected by Trade News

Here’s a list of major stocks and ETFs likely to experience volatility this week due to the ongoing trade policy:

$JNJ $ABBV $QCOM $CSCO $C $CORN $TSN $CHRW

$UBER $LULU $PFE $GEV $BIDU $AXP $MCK $NOW

$SPOT $CAT $ADBE $BSX $AMAT $TRULS $LIN $ELV

$ORCL $PEP $WFC $PGR $DIS $MS $INTU $MRK $LEBG

These companies span across pharma, semiconductors, financials, agriculture, industrials, tech, and logistics—sectors most exposed to tariff impacts and global trade flows.

📘 Final Thoughts

Volatility may dominate the near term, but long-term opportunities remain intact for patient, disciplined investors. As tariffs unfold and new trade relationships develop, sectors and companies will diverge based on their adaptability and resilience. Diversification, patience, and perspective remain the best tools in navigating today’s market turbulence.

📚 References

White House Official Tariff Policy Statement – April 5, 2025

U.S. Bureau of Labor Statistics – March Jobs Report

Reuters – Global Markets React to New U.S. Tariff

Trading Economics – U.S. 10-Year Treasury Yield

Statistics Canada – Q4 GDP Data

Elon Musk Commentary – CNBC Interview

Reuters – Kelly Ann Shaw Quote on Trade Policy

MarketWatch – Weekly Market Wrap (April 4, 2025)

$NVDA $TSLA $AAPL $AMZN $META $MSFT $PLTR $AVGO $MSTR $GOOG $AMD $NFLX $JPM $BAC $LLY $COST $UNH $V $XOM $MU $APP $GE $WMT $GS $CRM $MA $HOOD $TXN $INTC $JNJ $ADBE $BA $WFC $F $CSCO $NKE $PG $AMAT $CVX $ORCL $SMCI $SING $BKNG $HD $ABBV $KO $QCOM $MCD

#trading #forex #bitcoin #investing #trader #money #stockmarket #crypto #cryptocurrency #investment #forextrader #stocks #forextrading #business #invest #finance #btc #blockchain #daytrader #investor #entrepreneur #daytrading #tradingforex #forexsignals #ethereum #trade #financialfreedom #nifty #tradingstrategy #forexlifestyle #wallstreet #cryptotrading #success #motivation #wealth #technicalanalysis #forexmarket #sharemarket #profit #bitcoinmining #bitcoins #swingtrading #forexlife #tradingtips #stock #eth #binance #gold #fx #nse #traders #binaryoptions #investasi #stocktrading #cryptonews #millionaire #banknifty #stockmarketindia #bse #sensex