Market Review 4th April 2025

Simplify the craziness

DAILY REVIEW

N

4 min read

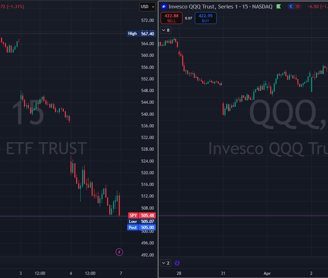

Markets Plummet as Trade War Intensifies

Equities closed sharply lower on Friday as China retaliated against U.S. tariffs with a steep 34% levy on American goods. This response followed President Trump's decision to raise tariffs on Chinese imports to 54%. The escalation sent markets into a tailspin, with the Dow Jones Industrial Average plunging 2,200 points, marking its worst single-day performance since 2020.

Key Highlights:

Nasdaq enters bear market territory, down 5.8% for the session.

S&P 500 sinks nearly 6%, capping its worst week since 2020.

Dow declines 5.5%, officially entering correction territory.

Asian and European markets tumble, led by Japan’s Nikkei dropping 2.75%.

U.S. dollar strengthens against major currencies but remains down 5% year-to-date.

Economic Data: U.S. vs. Canada Jobs Report

U.S. Job Market Shows Strength, But Recession Fears Grow

Despite market turmoil, the U.S. labor market showed resilience in March, with nonfarm payrolls adding 228,000 jobs, surpassing forecasts of 130,000. However, the unemployment rate ticked up to 4.2%, while wage growth missed expectations, rising only 3.8% annually instead of the anticipated 4.0%.

Leading Sectors:

Health care and retail trade accounted for 78,000 new jobs.

Revisions: January and February job data were revised lower by 48,000.

Canada Job Market Falters

Canada reported a job loss of 33,000 positions, significantly missing expectations of a 22,000 gain. The unemployment rate edged up to 6.7%, raising concerns about economic slowdown.

Bond Markets and Interest Rates

Yields Decline as Rate Cut Bets Increase

Bond markets surged as investors sought safe havens amid the sell-off. The 10-year U.S. Treasury yield fell to 3.9%, while the 10-year Government of Canada yield slipped to 2.86%.

Markets are pricing in four Fed rate cuts this year, significantly above the Fed’s dot plot projection of two cuts.

Federal Reserve Chair Jerome Powell acknowledged tariffs were "higher than anticipated" and stated that it’s "too soon to determine" the appropriate rate path.

Futures, Crude Oil, Gold & Other Commodities

Crude Oil Prices Drop on Demand Concerns

WTI crude oil fell 3.2% to $79.45 per barrel as demand concerns grew amid slowing economic growth.

Brent crude dropped 2.9% to $83.10 per barrel.

U.S. crude stockpiles increased by 4.3 million barrels, adding downward pressure on oil prices.

Gold Surges as Investors Seek Safe Haven

Gold rose 2.1% to $2,238 per ounce, benefiting from market volatility.

Silver climbed 1.8% to $26.45 per ounce.

Sector Analysis: Winners & Losers

Losers: Tech & Industrial Stocks Suffer

Tech and industrial stocks bore the brunt of the market decline due to their reliance on global supply chains.

Amazon (AMZN): Faces a potential $5B-$10B hit to annual operating profits due to tariff-induced cost increases.

Apple (AAPL): Heavily dependent on Chinese manufacturing, could face steep production cost surges.

Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA): All posted significant declines as trade uncertainty loomed.

Winners: Defensive Sectors Hold Up

While equities suffered across the board, defensive stocks in utilities, real estate, and financials proved relatively resilient.

Real estate (REITs) and utilities outperformed as investors sought stable dividend-paying stocks.

Banks suffered due to falling bond yields, which pressure lending margins.

Crypto Market Update

Bitcoin & Ethereum Decline Amid Risk-Off Sentiment

Bitcoin (BTC) fell 4.2% to $62,350, struggling to hold key support levels.

Ethereum (ETH) dropped 3.8% to $3,120.

Altcoins like Solana (SOL) and Cardano (ADA) saw similar declines of 5-7%.

Portfolio Strategies: What Investors Should Do Next

Diversification is Key

With stocks in correction and bear market territory, investors should maintain a well-balanced portfolio.

Avoid emotional trading – Market swings are normal in times of uncertainty.

Stay invested – Long-term investment strategies have historically outperformed short-term market timing.

Monitor exposure to trade-sensitive sectors – Industries like industrials, consumer discretionary, and technology may continue to face pressure.

Potential Market Recovery Factors

Despite the bearish sentiment, some market fundamentals remain positive:

Low unemployment continues to support economic resilience.

The Fed is still in a rate-cutting cycle, which could provide future support for equities.

Corporate profits are expected to rise, though at a slower pace than previously projected.

Potential policy shifts toward tax cuts or deregulation could boost investor confidence.

Conclusion: Navigating the Volatility

While the market downturn has been severe, historical data suggests that staying the course and maintaining a diversified portfolio remains the best strategy. Investors should brace for continued volatility as trade tensions evolve, but fundamentals indicate that the long-term outlook remains more balanced than it appears amid the current selloff.

References

$NVDA $TSLA $AAPL $AMZN $META $MSFT $PLTR $AVGO $GOOG $NFLX $JPM $AMD $UNH $COST $V $LLY $NKE $GS $BAC $AXP $INTC $MU $XOM $BA $GE $WMT $MA $C $CYK $HOOD $HD $MCD $JNJ $ABBV $QCOM $CSCO $CRM $COIN $TXN $CRWD $UBER $LULU $PG $GEV $BND $AXP $MCK $NOW $SPOT $CAT $ADBE $BSX $AMAT $TMO $LIN $ELV $ORCL $PEP $WFC $PGR $DIS $MS $INTU $MRK $LBRG

#trading #forex #bitcoin #investing #trader #money #stockmarket #crypto #cryptocurrency #investment #forextrader #stocks #forextrading #business #invest #finance #btc #blockchain #daytrader #investor #entrepreneur #daytrading #tradingforex #forexsignals #ethereum #trade #financialfreedom #nifty #tradingstrategy #forexlifestyle #wallstreet #cryptotrading #success #motivation #wealth #technicalanalysis #forexmarket #sharemarket #profit #bitcoinmining #bitcoins #swingtrading #forexlife #tradingtips #stock #eth #binance #gold #fx #nse #traders #binaryoptions #investasi #stocktrading #cryptonews #millionaire #banknifty #stockmarketindia #bse #sensex