Market Review 29th July 2024

Simplify the craziness

DAILY REVIEW

N

2 min read

Daily Market Summary

Market Overview

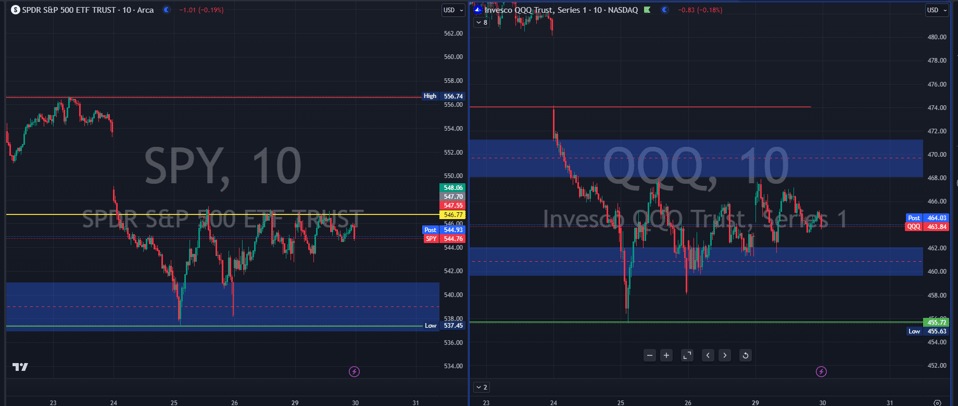

Stock markets started the week with mixed results after a strong rally on Friday. The technology-heavy Nasdaq and S&P 500 showed modest gains, while the Dow Jones and Canadian TSX closed slightly lower. Investors are eagerly awaiting the Federal Reserve meeting on Wednesday and the earnings reports of several mega-cap tech companies, including Microsoft, Meta, Apple, and Amazon, which could significantly influence market sentiment.

In July, the S&P 500 experienced a near 5% correction but now seems to be stabilizing, with a notable broadening of market leadership. The Russell 2000 small-cap index, for instance, has surged about 10% this month, while the S&P 500 remained flat. For the full year, the S&P 500 is up over 14%, compared to about 11.5% for the Russell 2000. This expanding market leadership suggests that diversification remains crucial for investor portfolios.

Key Highlights

Federal Reserve Meeting

The July FOMC meeting will conclude on Wednesday with a decision on interest rates. It is anticipated that the Fed will keep the federal funds rate steady at 5.25% - 5.5%, but may signal potential rate cuts later this year. Recent trends show easing inflation, with both CPI and PCE inflation moderating. The labor market has softened slightly, with the unemployment rate ticking up to 4.1% and wage gains slowing to below 4.0%. This backdrop supports a continued stock market expansion.

Upcoming U.S. Jobs Report

The U.S. July nonfarm-jobs report, due on Friday, is expected to show an increase of 175,000 jobs, down from last month’s 206,000 and below this year’s average of 222,000. The unemployment rate is expected to remain at 4.1%, with average hourly earnings forecast to dip from 3.9% year-over-year to 3.7%. The Fed will closely monitor wage growth data as it implies lower services inflation, supporting the narrative of a "soft landing" for the U.S. economy and moderating inflation.

Stock Market Movements

U.S. stock indexes had a mixed close on Monday, ahead of a busy week of earnings reports and a Federal Reserve meeting. The S&P 500 rose 0.1%, the Dow Jones Industrial Average dipped 0.1%, and the Nasdaq composite gained 0.1%. ON Semiconductor led the market with a 12% rise following a stronger-than-expected profit report. McDonald’s increased by 4.2% despite missing profit and revenue forecasts. Conversely, oil and gas companies, such as Exxon Mobil and Chevron, saw declines due to concerns about China's economy.

Big Tech Earnings

This week, significant reports from Microsoft, Meta Platforms, Apple, and Amazon are expected. These companies have considerable market influence and have driven the S&P 500 to multiple records this year. However, the recent underperformance of Tesla and Alphabet raised concerns that other tech giants might also disappoint.

Big Movers

ON Semiconductor+12.0%

McDonald's+4.2%

Exxon Mobil-0.9%

Chevron-0.9%

Tesla+3.5%

Alphabet-2.3%

Microsoft+0.8%

Meta Platforms+1.1%

Apple+0.9%

Amazon+1.0%

References

Mixed stock markets on Monday AP News

Federal Reserve Meeting Overview CNBC

U.S. Jobs Report Expectations Bloomberg

ON Semiconductor Earnings Reuters

McDonald's Earnings MarketWatch

Exxon Mobil and Chevron Declines CNN Business

Big Tech Earnings Overview Yahoo Finance

S&P 500 and Nasdaq Performance Business Insider

Bitcoin and Cryptocurrency News CoinDesk

Oil, Gold, and Treasury Yield Movements Investing.com

Japan and Hong Kong Stock Market Performance Nikkei Asia

FTSE 100 and Bank of England Meeting The Guardian